- Solutions

- Banking

-

- ACI ConneticUnified cloud payments platform

- AcquiringDigital acceptance, merchant management

- IssuingDigital payments and accounts issuing

- Fraud managementReal-time enterprise fraud management

- RTGS / Wires and cross-borderMulti-bank, multi-currency processing

- Real-time, instant paymentsComplete real-time payments processing

- ATMsSelf-service, omnichannel digital experience

- Central infrastructureInnovative real-time payment infrastructure

- NEW Redefining the payments hub: Solving today’s banking payment challenges

-

- Merchant payments

- ACI Payments Orchestration PlatformEnable customer journeys across commerce channels, accept payments, prevent fraud and optimize your payments journey

- In-storeDynamic, modern in-store payments

- eCommerceOnline and mobile payments

- Alternative payment methodsGive more ways to pay

- Value-added servicesEngagement, optimization and reporting

- Fraud managementEnd-to-end fraud orchestration

- Risk, security, and complianceAchieve and maintain compliance

- NEW Datos names ACI Worldwide best-in-class in payments orchestration

- Industries we serve

- Billing and bill payments

- ACI SpeedpayDrive customer satisfaction with the widest range of bill pay options in the industry.

- Bill payment APIs and SDKsOutsource bill payment processing

- Fraud managementAI-based fraud orchestration technology

- Alternative payment methodsGive more ways to pay

- Loan servicingPreferred loan payment options

- Treasury managementStreamline and integrate your back office

- Automated debt collectionImprove your collections process

- Digital walletsManage digital cards and payments

- PCI compliance and securityAchieve and maintain PCI compliance

- Industries We Serve

- Fraud management and payments intelligence

- Fraud managementFraud solutions to minimize risk and prevent fraud

- Fraud management for bankingEnterprise-wide fraud prevention

- Anti-money launderingStay ahead of money-laundering schemes

- Robotic process automationAutomate payment processing operations

- Fraud management in the cloudProtecting your business in the cloud

- Fraud management for merchantsProtect payments from end to end

- ChargebacksPrevent chargebacks before they happen

- SCA complianceAchieve and maintain SCA compliance

- Digital identity solutionsConfirm identities with behavioral analytics

- NEW Scamscope fraud report: APP scam trends from around the globe

Company CustomersPartners

CustomersPartners

Home

Four Questions to Drive Your Retail Banking Payments Strategy in 2019

I keep hearing that it’s “an exciting time to be in payments,” and I certainly agree that there is a lot of noise. However, when I look below the surface, I’d argue that the interesting activity is not with the payment itself, but with all the related events and steps in the value chain.

Let’s Get Phygital: eCommerce Is Coming to a Store Near You

While payments vendors continue to pitch and strategize with a focus on omnichannel, the omnichannel story has already moved on. Make no mistake – omnichannel remains important and the best vendors have solutions that provide a single cloud payments service capable of delivering a single view of the customer across stores and digital channels. And the best retailers utilize these solutions to deliver efficient cross-channel shopping experiences. Meanwhile, many other retailers get by (though seldom rise to the top) with a siloed approach.

What can the re-regulation of other industries tell us about open banking one year on?

UK Open Banking just reached its first birthday milestone (on January 13 to be precise) and given my own commentary – including in the ACI blog – on this topic, the first anniversary of Open Banking in the UK certainly won’t pass without a debrief on the progress that’s been made and what challenges lie ahead.

Around The World: Taking Stock of Global eCommerce in 2019

As I head to #NRF2019 in New York City next week, I’m excited to see how some of the biggest retailers and merchants see the industry evolving over the coming year. What trends they think are going to shape 2019, and which of 2018’s buzzwords can be put to bed.

A Pointless Credit Card World (Sound the Alarm, Ring the Bell, Freak Out… Le Freak, see’est Chic)

Mark, we were slightly prescient a few weeks back when our rantings touched on credit card points.

19 for 2019 (Payments Predictions Galore!)

As I’ve bid adieu to 2018, once again mumbling my way through Auld Lang Syne (reciting Burns poetry was never really in my 'wheelhouse,' as they say) I’m squarely focused on 2019 (and beyond), and the payments prognostications that typically accompany the start of a new calendar year.

Success speaks: how Roanoke College simplified higher education billing and commerce

Campus commerce has quickly become the ultimate test for payment software providers, IT professionals and administrators. Technology stacks and service offerings are continuously challenged by rapid innovation, just as budgets have begun to shrink. And to top it off, cybersecurity threats lurk around every corner, and even a single breach can destroy student confidence in their institution of higher learning.

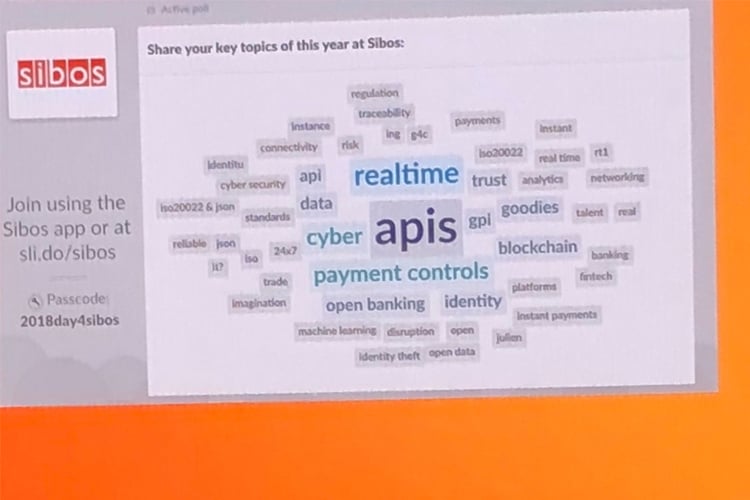

Monetizing Real-Time and Open Payments – A Global View from Leading Banks

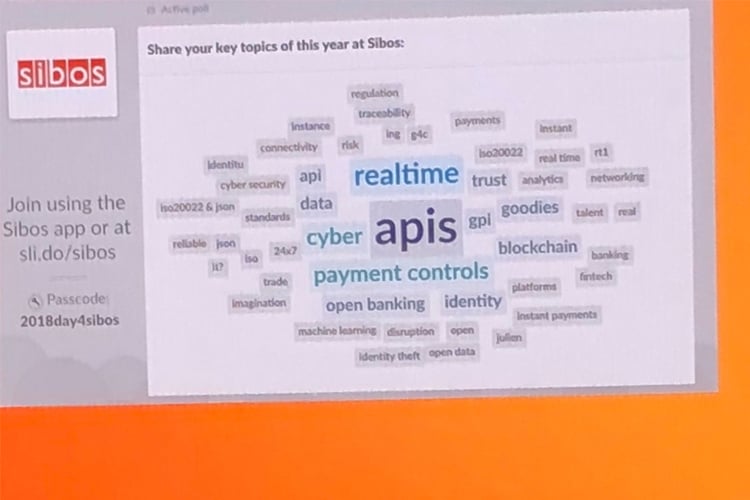

Payments experts from Bank of Montreal, Lloyds Bank and Rabobank lead a discussion on #NewPayments use cases. During Sibos 2018, I was lucky enough to moderate a panel of payments experts from around the globe, including banking leaders representing three key phases of the real-time evolution; early adoption, go-live and ‘wave 2.’ Here, I’d like to share insights from these experts, outlining the challenges and rewards for banks in the new real-time and open payments ecosystem.

All I Want For Christmas (Or Any Holiday) Is… Instant Payments Gratification

Mark, some of us are fast approaching the end of the holiday shopping season, some of us are fast approaching that time of year when we consume too much egg nog, and some of us are fast approaching too many viewings of Die Hard or It’s a Wonderful Life or Love Actually or Christmas in Connecticut (I’ve disclosed too much about myself). To segue slightly more than slightly, I was at Target over the weekend, braving the holiday shopping crowds, to buy toilet paper, paper towels and tissues… and I took advantage of the 5% off that I get from using my Red Card. I surveyed the throngs of other consumers in the nearby checkout lines and not once did I see another store card.

Fraudsters Don’t Wait for Peak, So Neither Should You: 2019 Fraud Strategy Starts Now!

In existence for barely two decades, eCommerce has transformed not only the way we shop, but also how retailers plan and execute their marketing strategies around the peak shopping season. Now that we’re deep into this period, retailers will have prepared for changes in buyer behaviors, relaxed their strategies to be within the limits of manageable review rate, and most important of all, put strategies in place for increased fraud attempts.

Instant Payments in Italy – And Beyond: Lessons from Il Salone Dei Pagamenti

ACI was invited back to Il Salone dei Pagamenti – Italy’s premier payments event organized by the Italian Banking Association (ABI) – to participate in a panel, “SEPA Inst – the Future.” As expected, the session was packed with stats and advice for a more efficient roll out of instant payments – in Italy and beyond.

The Power Behind Payments – Is It Time for the ‘Slow Fintech’ Movement?

According to a freshly-minted piece of research from the Dutch central bank, choosing card payments over cash is not only convenient, it’s also good for the environment. The study considers everything from the origin of cotton that goes into the production of (Euro) banknotes and the environmental impact of armored vehicles to transport cash, through to the energy usage of POS card payment terminals in standby mode.