- Solutions

- Banking

-

- ACI ConneticUnified cloud payments platform

- AcquiringDigital acceptance, merchant management

- IssuingDigital payments and accounts issuing

- Fraud managementReal-time enterprise fraud management

- RTGS / Wires and cross-borderMulti-bank, multi-currency processing

- Real-time, instant paymentsComplete real-time payments processing

- ATMsSelf-service, omnichannel digital experience

- Central infrastructureInnovative real-time payment infrastructure

- NEW Redefining the payments hub: Solving today’s banking payment challenges

-

- Merchant payments

- ACI Payments Orchestration PlatformEnable customer journeys across commerce channels, accept payments, prevent fraud and optimize your payments journey

- In-storeDynamic, modern in-store payments

- eCommerceOnline and mobile payments

- Alternative payment methodsGive more ways to pay

- Value-added servicesEngagement, optimization and reporting

- Fraud managementEnd-to-end fraud orchestration

- Risk, security, and complianceAchieve and maintain compliance

- NEW Datos names ACI Worldwide best-in-class in payments orchestration

- Industries we serve

- Billing and bill payments

- ACI SpeedpayDrive customer satisfaction with the widest range of bill pay options in the industry.

- Bill payment APIs and SDKsOutsource bill payment processing

- Fraud managementAI-based fraud orchestration technology

- Alternative payment methodsGive more ways to pay

- Loan servicingPreferred loan payment options

- Treasury managementStreamline and integrate your back office

- Automated debt collectionImprove your collections process

- Digital walletsManage digital cards and payments

- PCI compliance and securityAchieve and maintain PCI compliance

- Industries We Serve

- Fraud management and payments intelligence

- Fraud managementFraud solutions to minimize risk and prevent fraud

- Fraud management for bankingEnterprise-wide fraud prevention

- Anti-money launderingStay ahead of money-laundering schemes

- Robotic process automationAutomate payment processing operations

- Fraud management in the cloudProtecting your business in the cloud

- Fraud management for merchantsProtect payments from end to end

- ChargebacksPrevent chargebacks before they happen

- SCA complianceAchieve and maintain SCA compliance

- Digital identity solutionsConfirm identities with behavioral analytics

- NEW Scamscope fraud report: APP scam trends from around the globe

Company CustomersPartners

CustomersPartners

Home

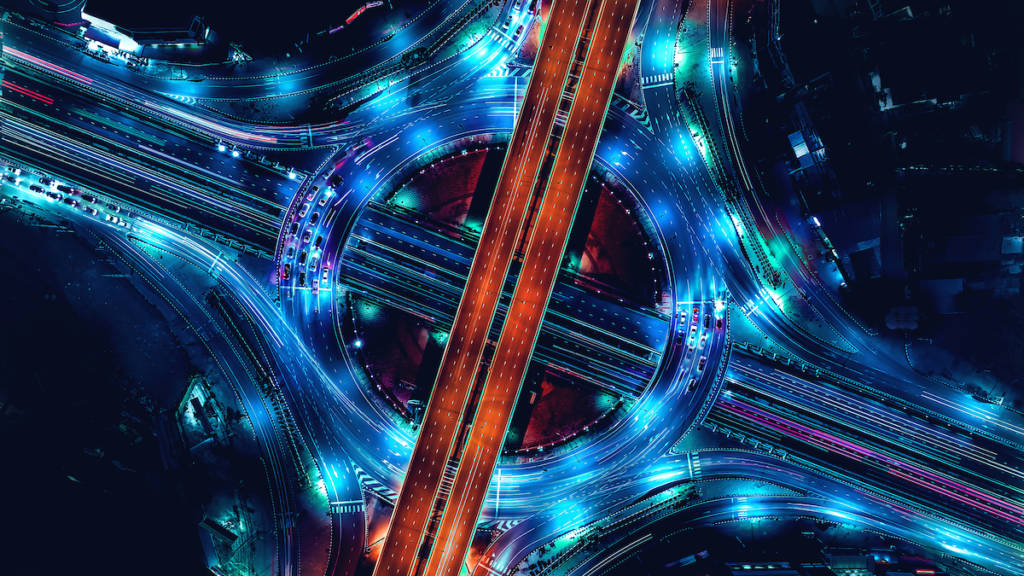

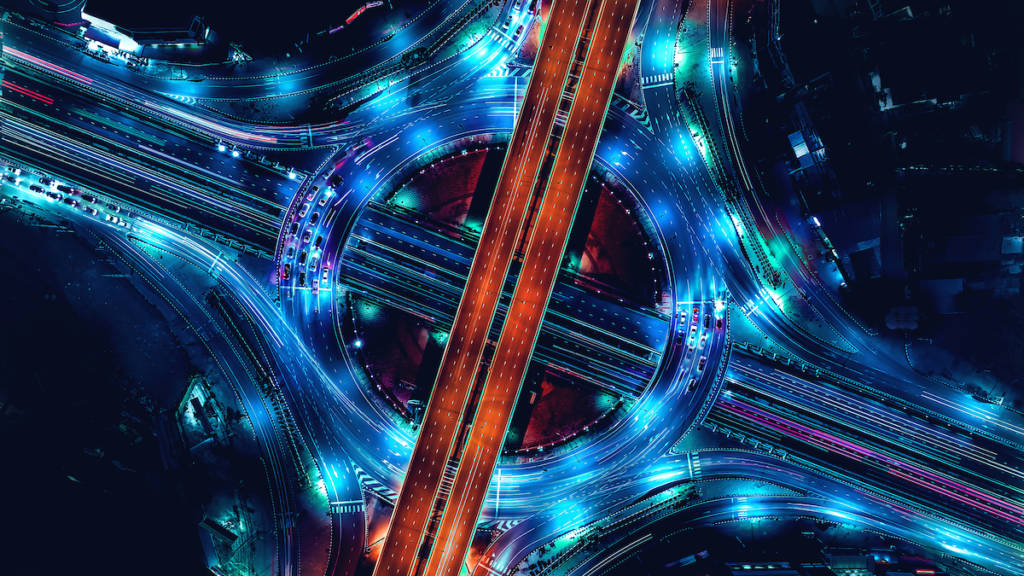

Where Payments Move Freely, Fraud Moves Fast: How to Clamp Down on Real-Time Fraud

Two steps forward and one step back? During the pandemic, real-time payments evolved faster than anybody had foreseen. Implementation in new markets, and adoption in mature markets, continues to rise exponentially. All corners of the financial landscape are adopting these changes.

The role of real-time payments in a better future for bill management

U.S. consumers are responsible for paying an average of 9.3 bills per month, according to our recent ACI Speedpay® Pulse. From rent and mortgage to utility services and essential subscription services, these payments impact the most essential parts of consumers’ lives.

Instant Payments: What Developments Would the European Commission Like to See?

On September 2, the European Commission (EC) published a document concerning the current and foreseeable benefits of instant payments. The EC document explains that instant payments can be used for transfers between individuals Person-to-Person (P2P) or Consumer-to-Consumer (C2C), and between individuals and businesses (B2C and C2B).

ISO 20022 for Europe: How to Speak the New Language of High-Value and Real-Time Payments

The implementation of the ISO 20022 data standard for financial messaging has been accepted by major central banks, payment schemes around the world and system operators including SWIFT.

Fraud Prevention on Subscription Plan: What Makes It an Attractive Model for Banks? [Q&A]

From music and movies to steaks and pet toys, subscription services are everywhere. In the U.S. alone, 69 percent of the population are subscribed to multiple services and 28 percent have at least four.

Why Real-Time Payments and Why Now?

As evidenced by ACI’s most recent Prime Time for Real-Timeglobal payments report, the real-time payments revolution has taken hold around the world. Consider, in just the past year and a half: India’s UPI set a record for monthly transactions with more than 3.5 billion in August 2021 The U.S.

Understanding alternative (bill) payment methods

Apple first introduced Apple Pay on September 9, 2014, promoting it as “a new category of service that will transform mobile payments with an easy, secure and private way to pay.

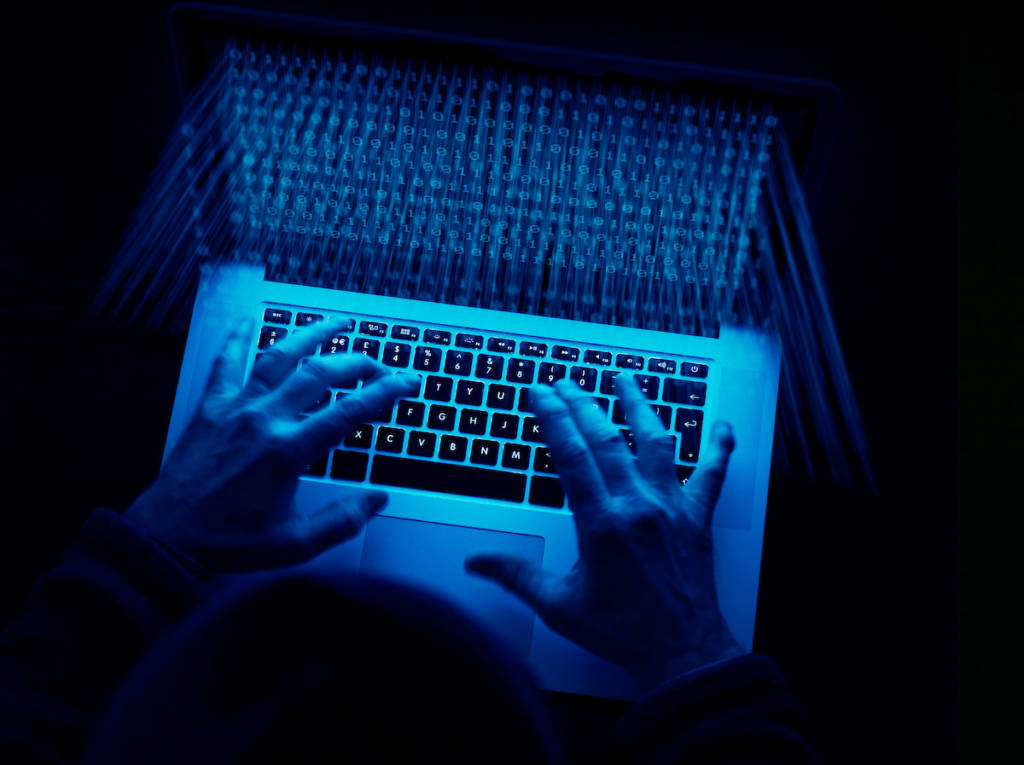

Getting Medieval: A (Modern) Multilayered Approach to Payments Security

PCI compliance is a detailed and grueling process for a reason; fraudsters will exploit any weakness they can uncover. History has shown that even major merchants that consumers would assume are fully protected can get breached.

Payments Orchestration: Music to the ears of merchants?

Payments orchestration is about maximizing payment conversion in the most cost effective way. It involves working with multiple payment providers, acquirers and banks to optimize the customer experience, increase conversions, ensure regulatory compliance, enhance fraud prevention and enable global payments coverage.

The European Commission’s Anti-Money Laundering and Countering Terrorist Financing Legislative Package: A Move Towards a More Effective Enforcement of EU AML/CTF Rules?

On 20 July 2021, the European Commission published an anti-money laundering and countering terrorist financing (AML/CTF) legislative package.

Big Data, Bigger Potential: How Retailers Can Benefit From Payment Analytics

Our lives are now subjected to more statistical analysis than ever before.

How Will Accelerated Adoption of Digital, Real-Time Payments in the U.S. and Beyond Lead to More Fraud?

The payments industry is brimming with experts voicing the predication that the future is digital and real-time. Rooted in consumers’ growing desire for convenience and waning patience, rising demand for digital and real-time payments is inevitable.